Tax Specialist Resume

Dow jones company scott la.

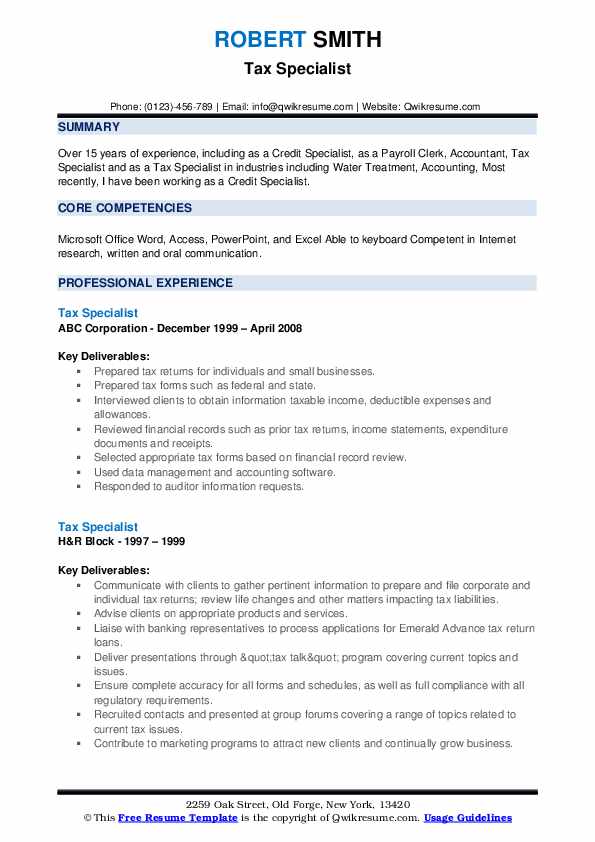

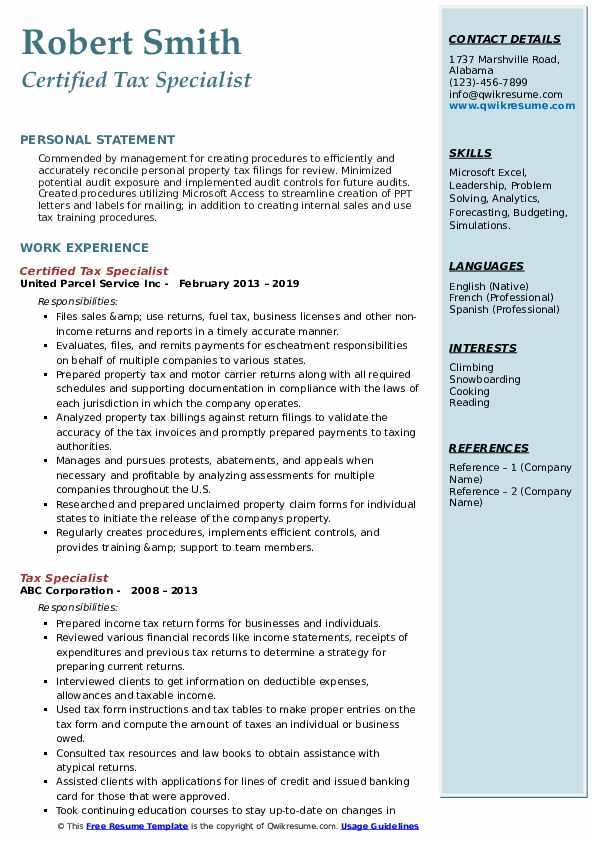

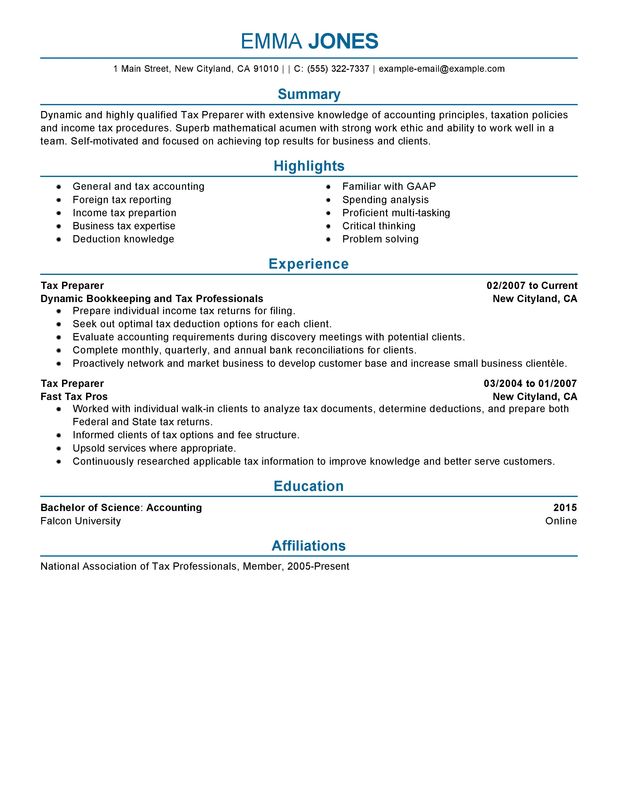

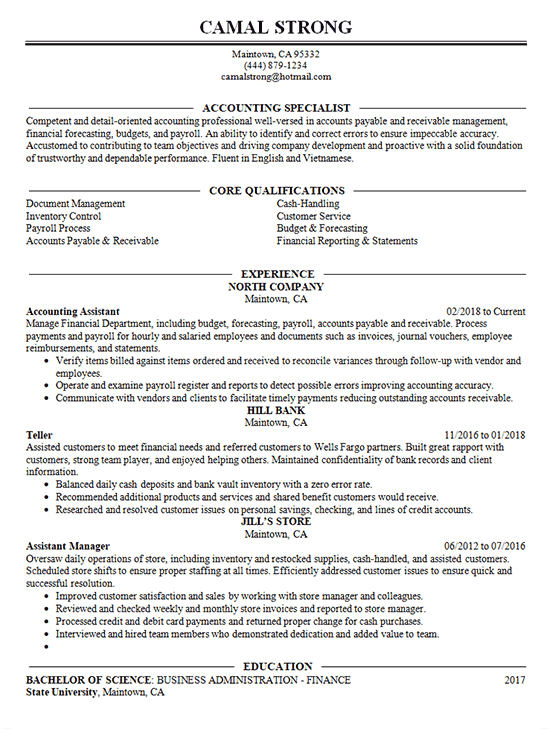

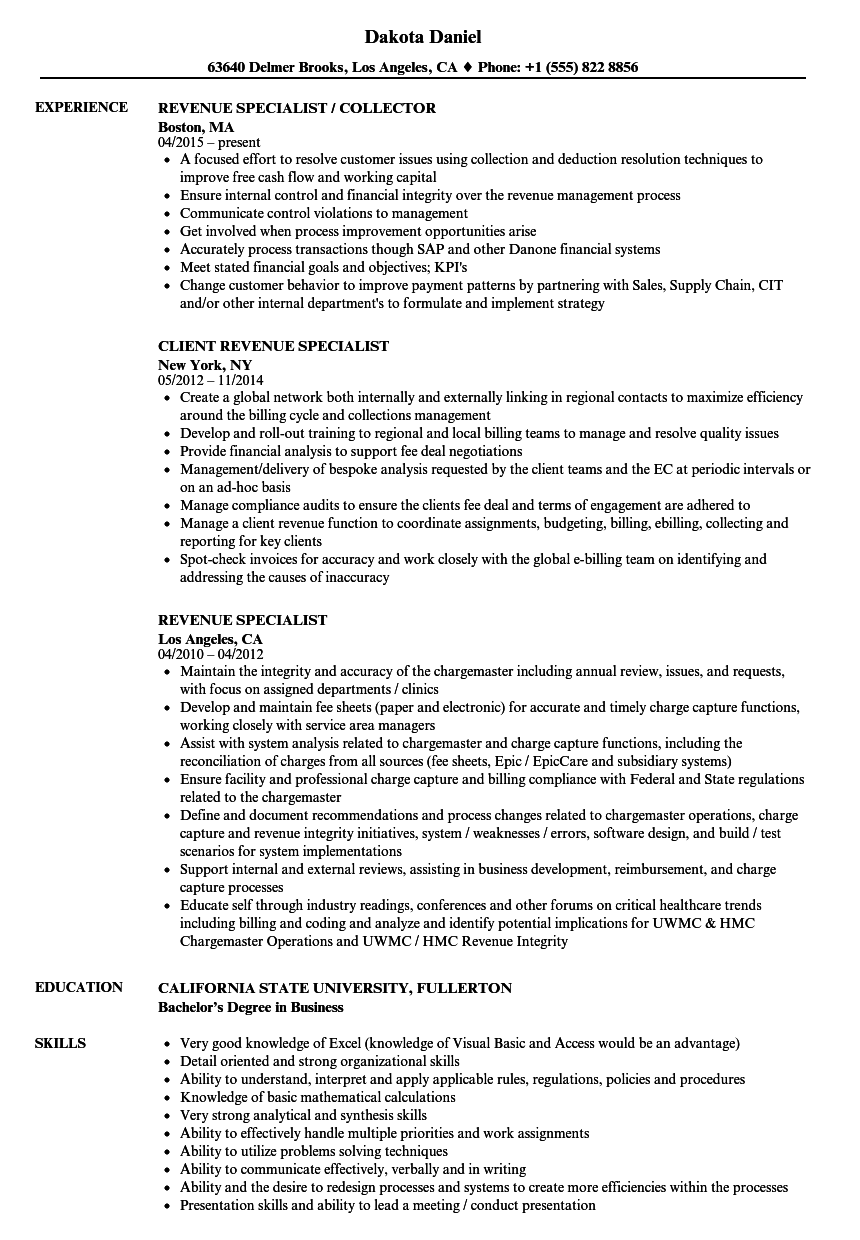

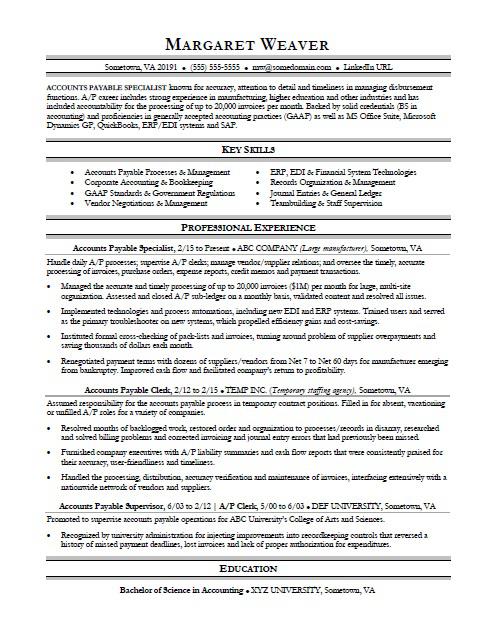

Tax specialist resume. Multi faceted professional with areas of expertise in accounting tax knowledge and preparation strong business background. Preparation reconciliation and filing of taxes particularly withholding on compensation expanded withholding fringe benefit tax documentary stamp tax thru bir efps assist in completion and coordination of compliance requirements with responsible department corporate office. Use this tax preparer resume example as a guide and divide your document into distinct sections highlighting your education skills and relevant experience. Resume tips for tax preparer if you are looking for jobs as a tax preparer and the surrounding area you would use the same job search methods that you would in other parts of the country.

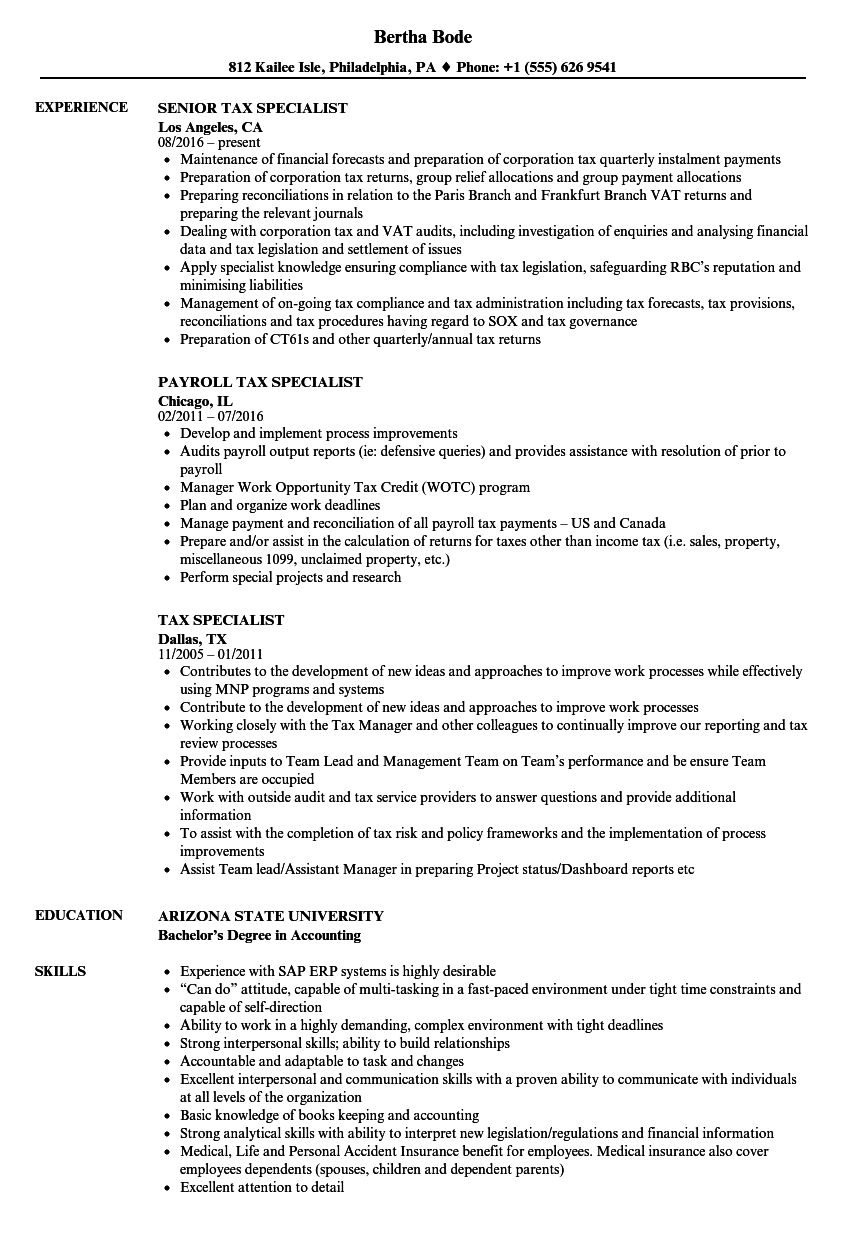

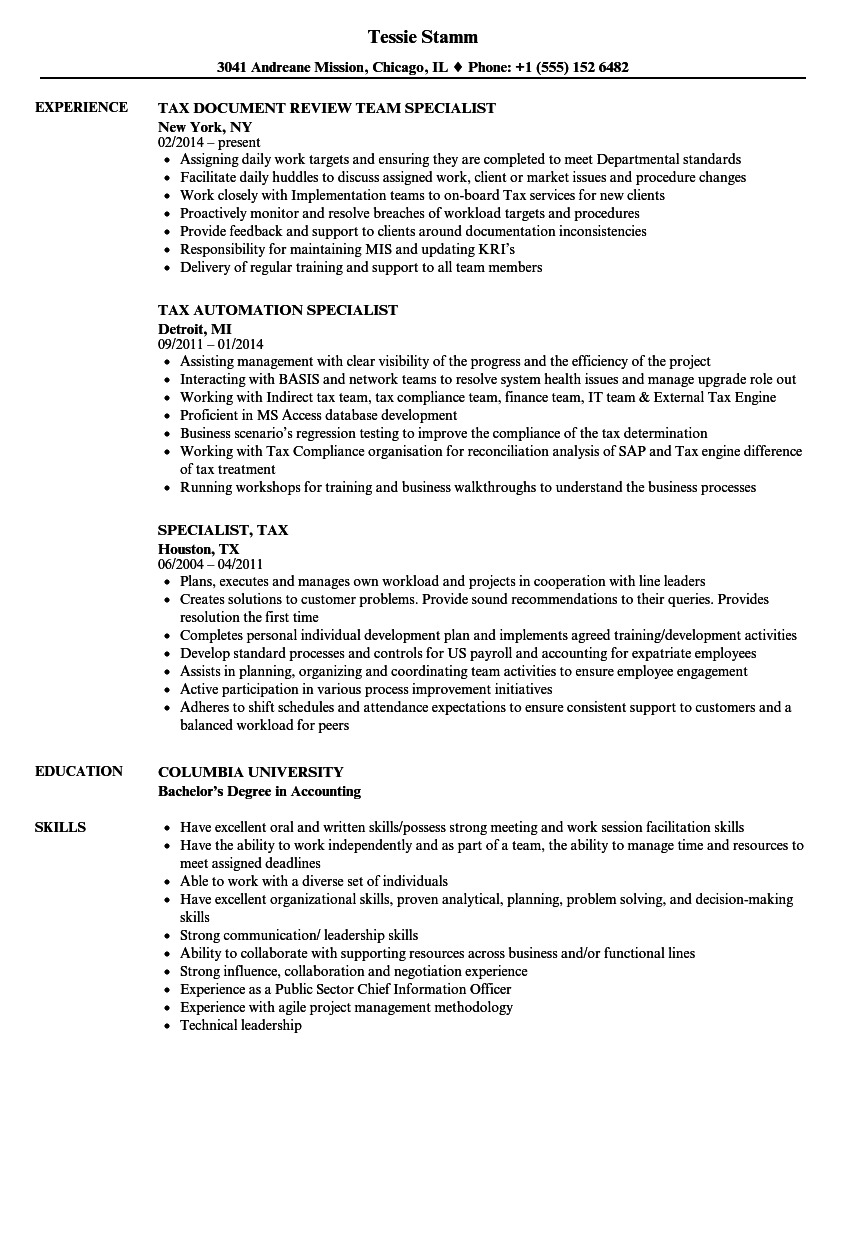

The main job role of the tax specialist is to contribute to the preparation of the financial statements of the clients of the firm. Successfully managed a 3000 hour engagement with a tight budget and daily deadlines while supervising directing and coaching a team of five. Tax specialist resume examples samples. Proficient at documenting supporting and researching all tax compliance laws.

Prepared corporate income and partnership tax with federal and state. Maintained related files and databases coordinated processing and mailings of all extensions and returns. A tax specialist possesses in depth knowledge about tax accounting and well trained in tax laws. Heshe adds the input to those financial statements or tax planning to make them more valuable.

Tax specialist may 2006 present. Extremely knowledgeable and analytical tax specialist has excellent tax accounting skills and the ability to effectively audit tax informationhas superior accounting skills and thorough knowledge of all tax laws regulations and current updatespossesses both masters and bachelors degrees in accounting certification as a cpa and more than nine years of tax specialist experience. The main role of a tax specialist is to add valuable inputs in financial planning and tax planning of the clients. Tax specialist resume a tax specialist is a financial expert who specializes in accounting tax and is well trained in tax laws.

Resolved tax issues and handled tax notices and inquiries from federal and state agencies. Tax specialist resume tax specialists maintain clients portfolios and help them in saving tax and avoid legal hassles. They file individual or corporate tax by following federal norms obtain the returns and suggest tax saving options. Expert tax specialist who is adept at making sure that quarterly and annual federal and selected international tax compliance is met while balancing client meetings with in office duties.