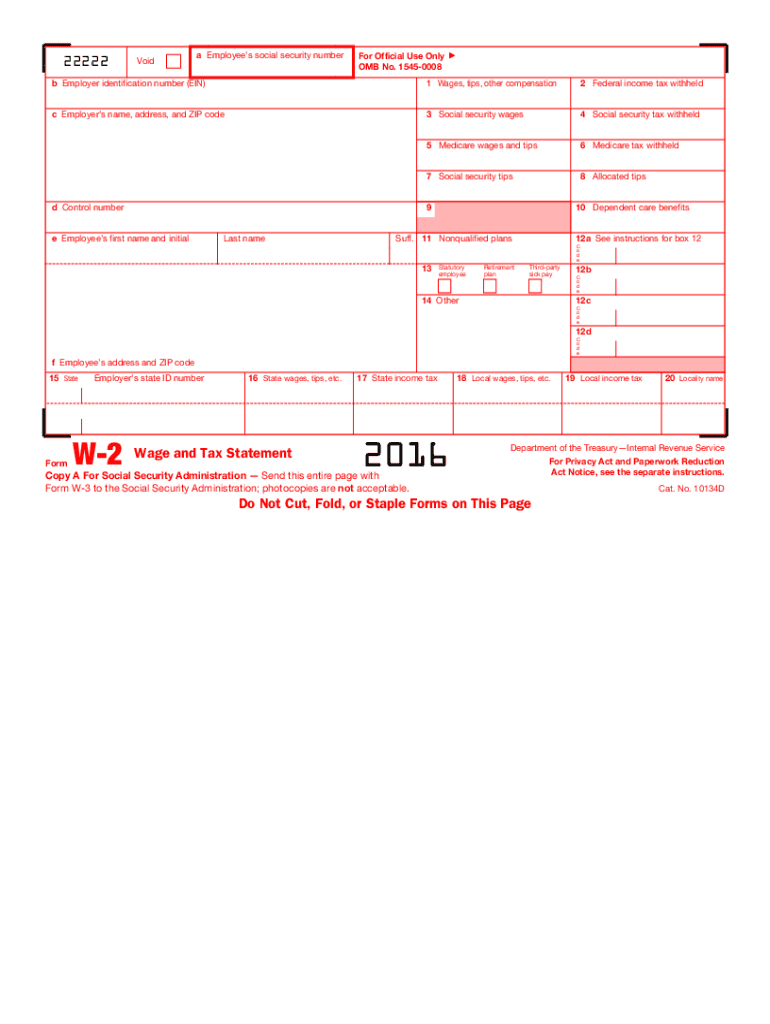

Irs W2 Form 2016 Printable

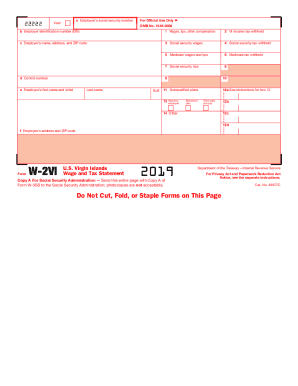

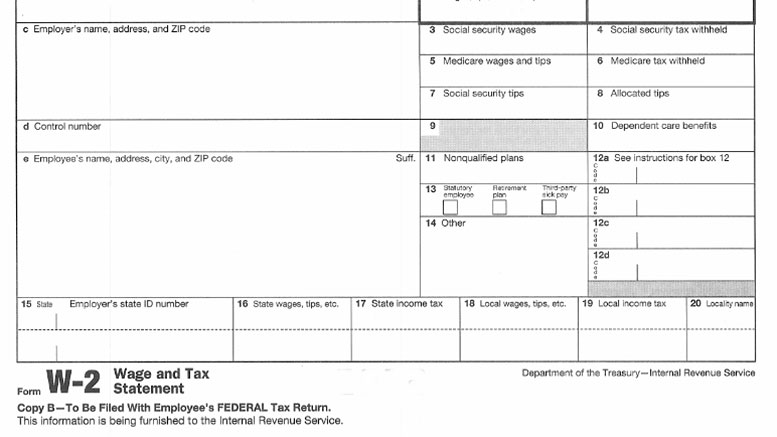

Instructions for forms w 2 and w 3 wage and tax statement and transmittal of wage and tax statements 2018 03072019 inst w 2 and w 3.

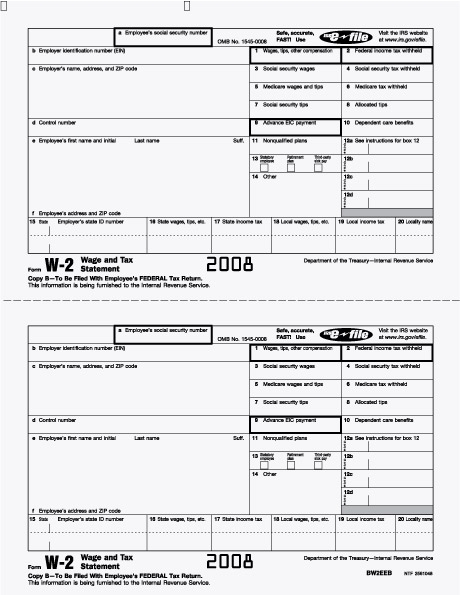

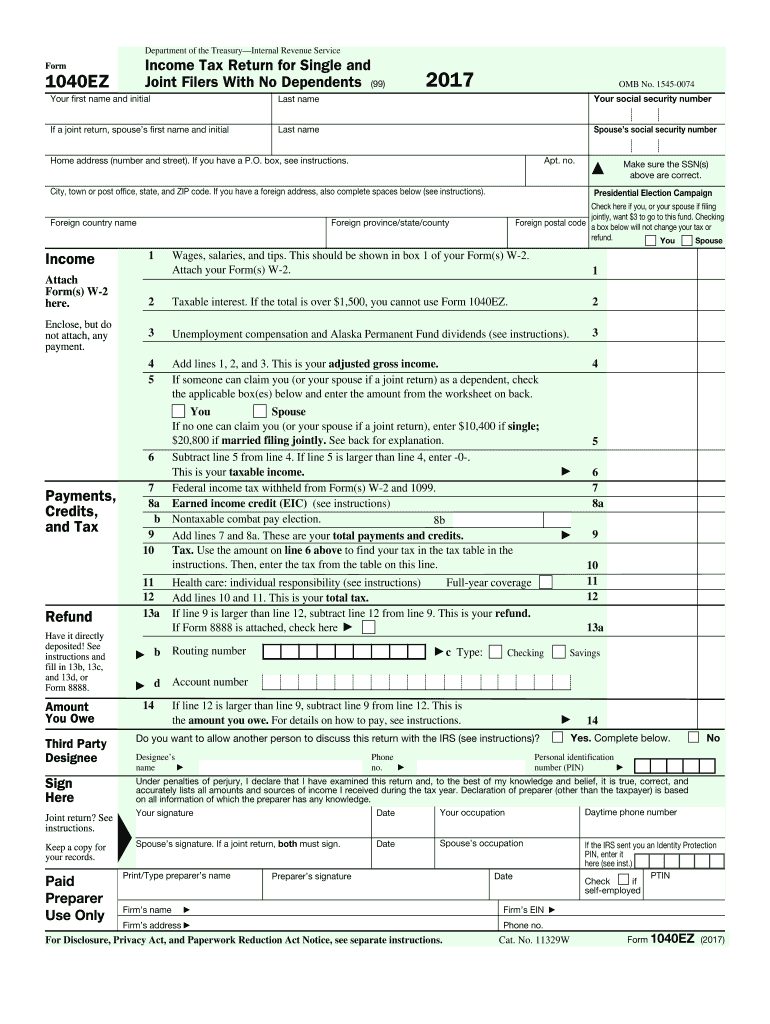

Irs w2 form 2016 printable. Distribute the ready document through electronic mail or fax print it out or download on your gadget. Copy bto be filed with employees federal tax return. If you e filed your tax return or you didnt attach your form w 2 to your paper return then use one of the transcript options above. Once the form is done click done.

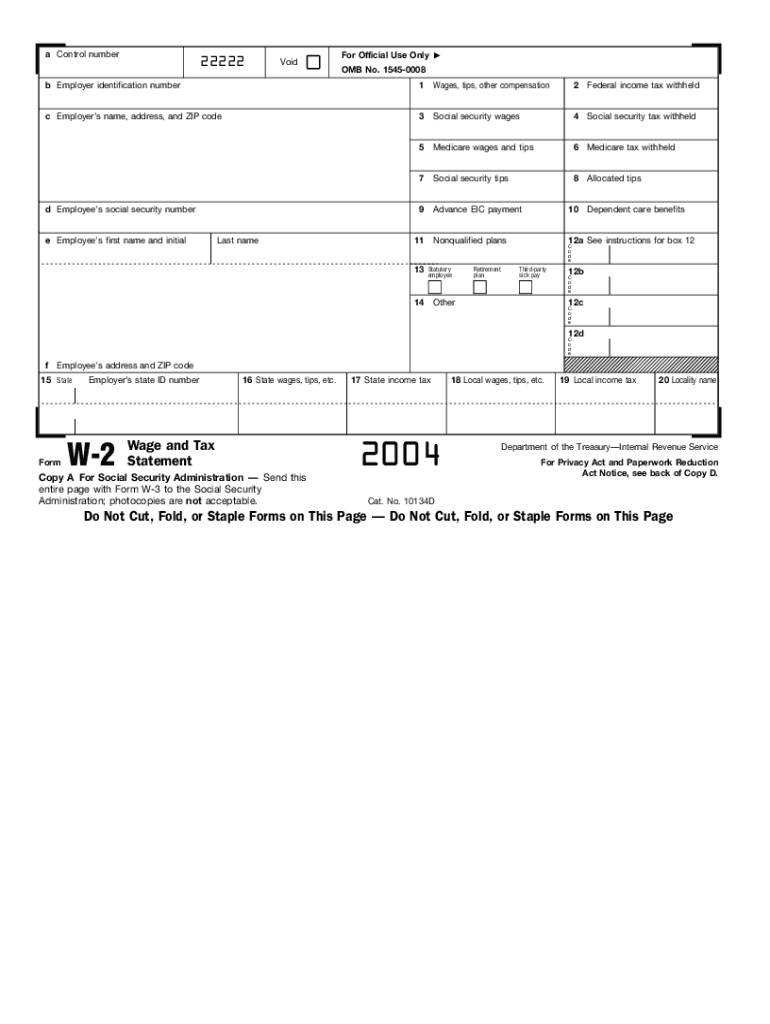

See the penalties section in the current general instructions for forms w 2 and w 3 for more information. American samoa wage and tax statement. Wage and tax statement. Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or medicare tax was withheld for services performed by an employee must file a form w 2 for each employee even if the employee is related to the employer from whom.

This information is being furnished to the internal revenue service. Put an digital signature on your irs w 2 2016 printable using the assistance of sign tool. Otherwise youll need to contact your employer or ssa for a copy. The quickest way to obtain a copy of your current year form w 2 is through your employer.

The official printed version of this irs form is scannable but the online version of it printed from this website is not. Instructions for forms w 2 and w 3 wage and tax statement and transmittal of wage and tax statements 2019 01302019 form w 2as. Department of the treasuryinternal revenue service.